“Salesforce (CRM) Faces Investor Scrutiny: Revenue Misses Expectations, Outlook Cautious – Analysts Stay Positive Despite Stock Plunge”

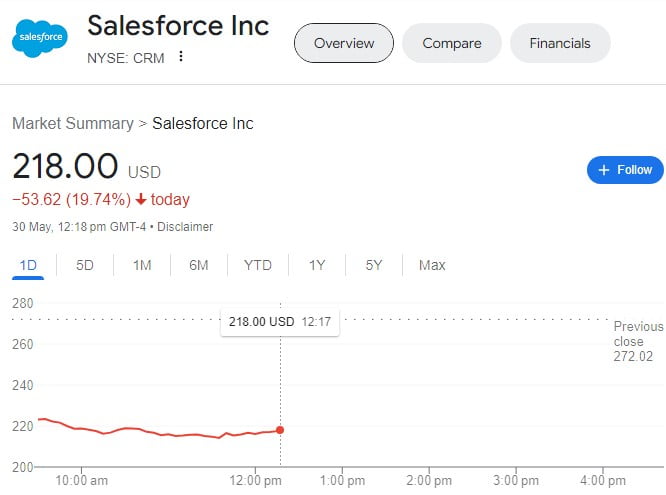

Salesforce (CRM) experienced a drop in its proportion on Thursday following a weaker-than-predicted revenue in the first zone and a tender outlook for the second sector. The organisation’s stocks plummeted by way of more than 20% in early buying and selling, making it the worst performer of the day.

According to the record, Salesforce, a Software-as-a-Service (SaaS) issuer, failed to meet its financial expectancies for the first region and issued a careful outlook for the second quarter. Despite a yr-over-year sales boom of eleven% to .Thirteen billion and a 44.4% upward push in earnings per percentage (EPS) to .44 for the ending region of April, the marketplace become disenchanted with the organization’s overall performance.

Salesforce CEO Mark Benioff said, “The tempo of our profitable boom is reinforced by strong cash go with the flow generation.With AI, we are only getting started on a huge opportunity to communicate with our clients in completely new ways.” He highlighted the company’s position as the world’s top AI-powered CRM and its commitment to assisting organisations in realising the potential of AI in the upcoming ten years.

Analysts had combined expectations. While Wall Street was expecting sales of $nine.17 billion and earnings according to share of .38, Salesforce projected sales among .2 billion and .25 billion and EPS between .34 and .36 for the second quarter, falling short of Wall Street’s estimates.

Amy Weaver, Salesforce’s Chief Financial Officer, attributed the shortfall to “hard macroeconomic situations,” “reduced spending in transactions,” and “delays or slowdowns in patron initiatives.” For the whole year, Salesforce maintained its revenue steerage among .7 billion and billion and multiplied its EPS guidance from .68 to a number of $nine.76 to $nine.Ninety four.

Now, the big query is whether or not Salesforce stock is well worth shopping for, promoting, or protecting.Analysts, however, are still optimistic about CRM stock.

Analysts, however, are still optimistic about CRM stock.Analysts, however, are still optimistic about CRM stock.Analysts maintain a positive outlook on the CRM stock, expressing ongoing optimism amidst market fluctuations.

Tech shares have been suffering in 2024, with a modest 3% growth via the quit of May. “

Kiplinger PF:https://www.kiplinger.com/

[…] Read More: […]