AMD Stock Analysis: Q1 2024 Earnings Review and Growth Outlook

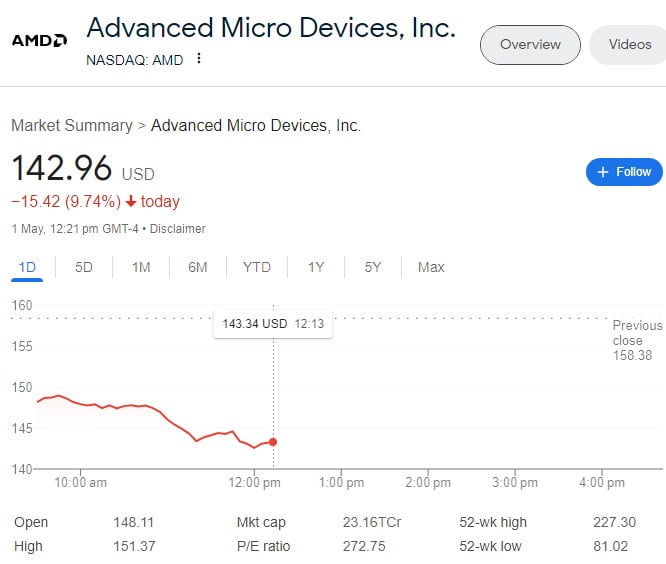

“Advanced Micro Devices (NASDAQ: AMD) witnessed a 5.5% decline in its shares during pre-market trading on Wednesday after posting inline earnings per share (EPS) by the chip-making giant for the first quarter of the fiscal year 2024.

Specifically, the company posted an EPS of Specifically, the company posted an EPS of Specifically, the company posted an EPS of Specifically, the company posted an EPS of $0.62, in line with analysts’ estimates..62, in line with analysts’ estimates..62, in line with analysts’ estimates..62, in line with analysts’ estimates. The quarter’s revenue of.5 billion was somewhat more than the.48 billion average expectation.

The non-GAAP total margin for the quarter increased by 2 percentage points year-over-year, reaching 52%.

AMD’s President and CEO stated, ‘We delivered strong results in the first quarter with our data center and client segments, each seeing over 80% year-over-year growth in shipments of our AMD EPYC and Ryzen processors.‘

Looking ahead, AMD expects revenue for the second quarter of 2024 to be between .4 billion and billion, while the consensus estimate was .7 billion. The company anticipates this range reflects approximately 6% sequential growth and approximately 4% year-over-year growth.

AMD also expects its non-GAAP total margin for the quarter to be approximately 53%.

Additionally, the company adjusted its 2024 revenue outlook for its data center GPU segment from .5 billion to billion. However, analysts at Goldman Sachs noted in a memo, ‘The revision may weaken investors’ fastest-growing expectations.‘

Nevertheless, Wall Street analysts remain confident in AMD’s strategy, stating that ‘AMD is making appropriate investments, and we have a long-term product roadmap to benefit from the growth in AI fundamental infrastructure expenses.’

Goldman Sachs lowered its 12-month target price from 0 to 5 while reiterating its buy rating on the stock.

Stifel analysts, however, expressed a similar sense of optimism, pointing out that AMD has notified a number of significant clients, such as Microsoft, Meta, and Oracle, about the wider rollout of its AMD EPYC 300 systems.

‘We believe this momentum is a positive indicator for AMD’s sustained traction as its AI compute roadmap continues to evolve,’ stated Stifel. The fact that AMD has acknowledged that user input influences roadmap selections for AI hardware and software is noteworthy.

Yahoo Finance:https://finance.yahoo.com/